- Virginia Adopts First-in-the-Nation Workplace Safety Standards for COVID-19 Pandemic

- Employer Guidance

- Families First Coronavirus Response Act

- Carrier Information

- BBG Response

- DOL Information and Guidance

- Special Enrollment and Eligibility Update (COVID-19, VA)

- Attorney Guidance

- DC Health Link Resources

- ThinkHR COVID-19 Employer FAQ

Employer Guidance

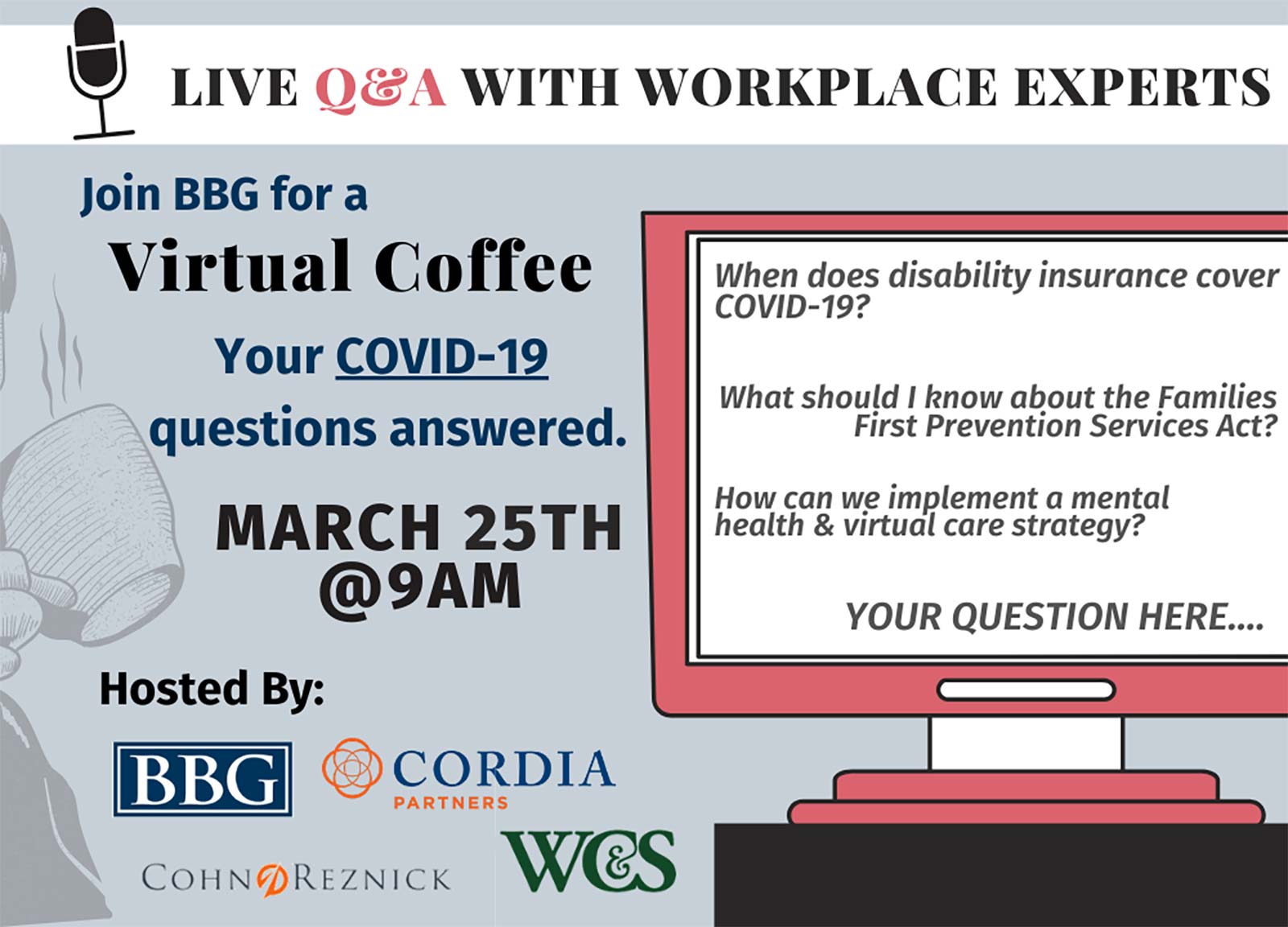

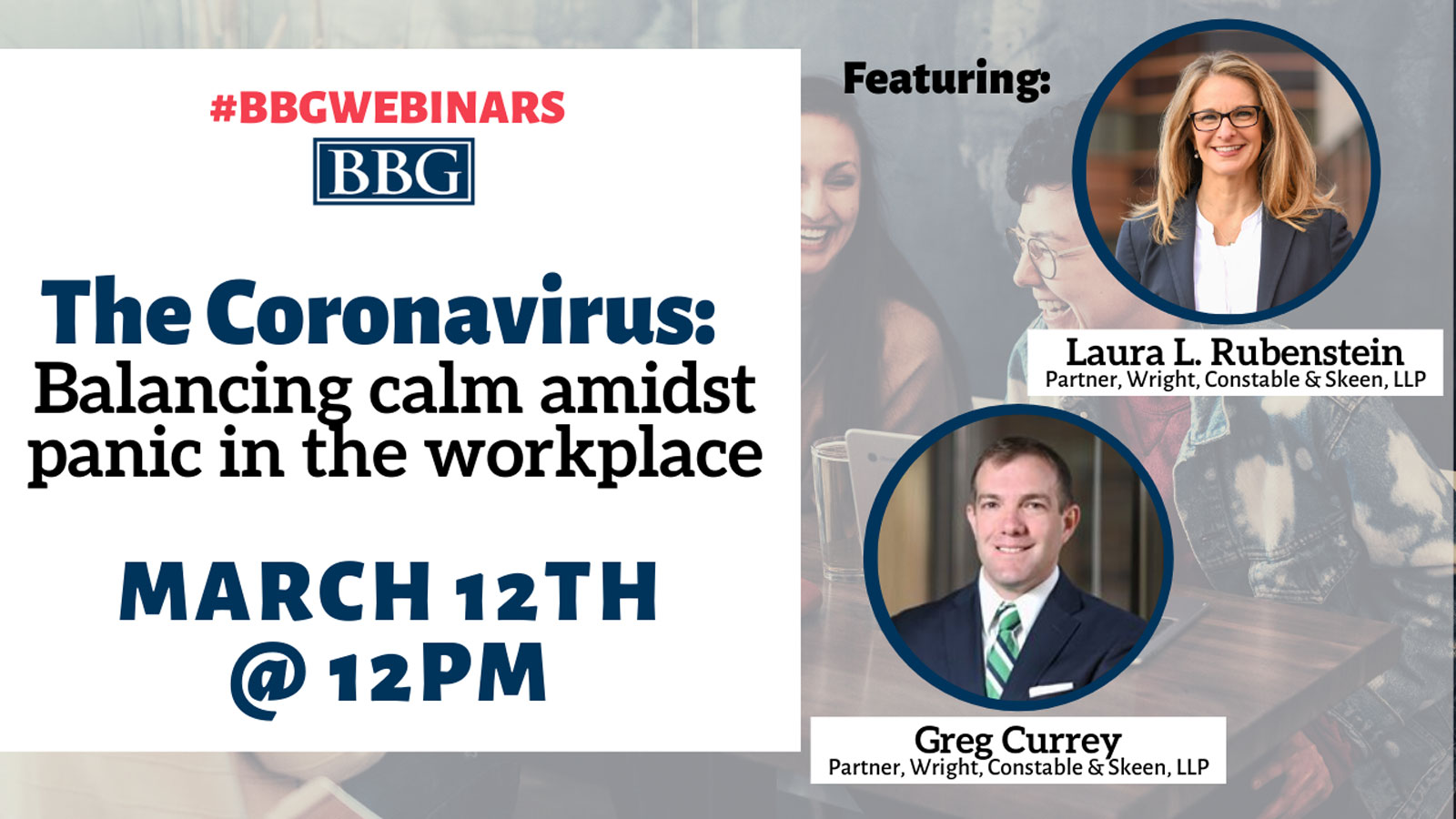

As coronavirus continues to impact businesses, please view our webinars on how to deal with coronavirus in the workplace.

As a black swan event, the situation continues to develop, is changing by the moment, but is already leading to:

- School closures for longer than currently forecasted times

- “Essential personnel only” policies

- Rotating work schedules

- Reduction in hours

- Layoffs

- Shutdowns

- And more.

We wanted to provide a comprehensive and practical guide to help provide added support and guidance in a time of uncertainty. Please consider these items as a start, but please also keep in mind that we are here to support all clients in these uncertain times.

Health & Benefits – General Items

Given not only these issues, but a concern for the strain on the health care supply chain, and quarantines, please make it a priority to communicate additional benefits such as Telemedicine, Mental Health, and EAP solutions clearly and effectively to employees.

- If an employee is suffering for shortness of breath or having difficulty breathing, they should immediately go to the Emergency Room. As always, encourage employees to use their best judgement.

Disability Coverage

Many clients have had concerns regarding Disability policies.

- If an individual is disabled due to an illness, they may be entitled to Disability benefits.

- Disability policies are designed to cover a loss of income associated with an injury or illness and may not apply to quarantines.

- If coverage is terminated, benefits would not be available to cover disabilities resulting from an injury or illness.

COVID-19 Testing and Treatment

Benefits are provided for these covered items; however patient cost shares may apply.

- Most Fully Insured health plans have waived member cost shares, while Self-Insured and ASO policies have the option of waiving these cost shares.

- You may visit this link to see how your insurer is handling these items. Carrier Updates

- Federal legislation is still pending on these items but expected to be solidified the week of March 16, 2020.

- The IRS has provided guidance that if a Qualified HSA plan opts to cover testing as first dollar coverage, the plan will not lose its Qualified HSA status.

Travel, Self-Quarantines, EEOC guidance

We recommend that businesses have clear policies regarding travel, self-quarantine criteria, reporting of illnesses, and more. Should an employee be symptomatic, or potentially have been exposed to COVID-19, many businesses are proceeding with a minimum 14-day quarantine/isolation.

- Employers should also carefully consider the intersection of leave policies, such as Sick-Leave, PTO, FMLA, Short Term Disability, and more as it relates to their ongoing pandemic response.

(Pre)Pandemic Survey

At this time, if businesses have not completed an ADA compliant pre-pandemic survey, we recommend that these be completed given the potential that individuals may not be able to report to work due to childcare, transportation, or other issues. You will find the entire EEOC Pandemic Response toolkit at this link: https://www.eeoc.gov/facts/pandemic_flu.html

- The EEOC has also posed updated guidance regarding COVID-19, which can be found at this link: https://www.eeoc.gov/eeoc/newsroom/wysk/wysk_ada_rehabilitaion_act_coronavirus.cfm

Layoffs and Furloughs

We are seeing our first rounds of layoffs, specifically in areas impacted by county-wide quarantines/shelter in place orders. We anticipate this to grow, as layoffs are also hitting in the National Capital Region, especially in the restaurant and service industry.

In addition, we know that several Government Agencies have already moved to either remote work, essential personnel only, or other measures to reduce the density of the workforce, such as shift changes, rotation schedules, and more. The later of these can be problematic in several areas of benefits, so please read on.

Please consider these items very carefully as they relate to your workforce.

- Exempt vs. Non-Exempt employees – Per the Fair Labor Standards Act (FLSA), for any time worked within a week by an Exempt employee, you as the employer are required to pay them for the full week. Employees can choose to take Vacation or PTO leave, however if the employee does not have this type of benefit available, they would still need to be paid for the entire week in which they performed work. For Non-exempt employees, they would only be paid for hours worked.

- http://webapps.dol.gov/elaws/whd/flsa/Overtime/cr4.htm This link provides you with all the allowed and not allowed deductions from an Exempt employee’s checks.

- An employer may not make deductions from an exempt employee’s pay for absences caused by the employer or by the operating requirements of the business. If the exempt employee is ready, willing and able to work, an employer cannot make deductions from the exempt employee’s pay when no work is available. If no work is performed within the entire week, then Exempt pay can be withheld.

- Benefits/401(k) Continuation – the majority of BBG clients have been plans that run through the end of the month, however this may vary on a contract-by-contract basis. Unless you have a Date of Termination rule on your benefit plans, the following would apply.

- In prior cases of government shutdown, layoff or furlough, most clients have left employee benefits active through the month in which the shutdown occurs, but once April begins, we may advise converting employees over to COBRA or State Continuation coverages dependent on the is expected to remain, so that they pay 100% of the premium. This will depend on each of your individual situations. We will be happy to advise you in each situation if you need help.

- Additionally, many Medical, Dental and Vision policies accommodate up to 90 days of leave without pay, prior to being in a position of terminating benefits, and activating COBRA or State Continuation where applicable, such as health benefits.

- Life and Disability benefits generally carry a termination date of date of termination, or end of month of termination.

- Given this, we recommend including portability and conversion paperwork in employee offboarding materials for Life Insurance. Individuals will then complete and file with the Life Insurer should they wish to continue coverage.

- Businesses may choose to forego 30 days of leave without pay, and instead terminate benefits as they would in a total lay-off situation.

- COBRA and Continuation rules would apply for Medical/Dental/Vision benefits. For Life/Disability, portability and conversion would apply assuming these are covered in your contract, and individuals are actively at work on the date of termination.

- If your company is moving to a reduced work hours schedule, there are several options you have:

- If you wish to maintain benefits coverage, you should clear any reduction in minimum hours (IE: moving eligibility from 30 hours per week to 20 hours per week) with your insurers.

- If you are self-funded, this would include an amendment to your SPD, however you should also secure approval from your stop-loss insurer.

- If you wish to terminate benefits coverage for a population/workforce that fails to meet the minimum hours requirement, you may do so.

- Unemployment – if your employees are unable to work due to layoff, termination, etc, they can file for unemployment in the state in which they performed work. Most states previously had a 3-7 day waiting period before they begin receiving these payments, however we are beginning to see these waiting periods waived in certain states. Almost all State Unemployment offices are posting a Frequently Asked Questions section regarding the current status of COVID-19 and we’ve included links to DC, MD & VA below for you.

- MD – Link to State FAQ website re: Unemployment Insurance

- VA – Link to State FAQ website re: Unemployment Insurance

- DC – Link to start the Unemployment process (no FAQ’s available)

- WARN Notifications – Employers with 100 or more employees, who need to layoff or terminate 50 or more employees at once, will need to follow Federal guidelines regarding providing a formal Layoff notice to their affected employees and also notifying the Local Chief Elected Official and the state dislocated worker unit (Unemployment Office). There is a 60 day layoff notice requirement, however BBG has spoken with our Labor Attorneys who feel that this requirement should be defensible given the current COVID-19 conditions.

You will want to be clear and concise with your employees on how each of these matters may or may not affect them, and our HR Division here at BBG is available to help you with any questions they may have. Please email us at bbghr@bbgbroker.com with any questions you may have. We will respond to the emails and calls in the order in which they are received to assist you as much as we can as we understand the challenges presented during these troubling times.

Additionally, clients may access ThinkHR for afterhours support, or general inquiries at any time.

Frequently Asked Questions

We have provided additional FAQ’s below that may be relevant for other matters related to COVID-19 and the workplace.

How much information may an employer request from an employee who calls in sick, in order to protect the rest of its workforce during the COVID-19 pandemic?

During a pandemic, ADA-covered employers may ask employees if they are experiencing symptoms of the pandemic virus. For COVID-19, these include symptoms such as fever, chills, cough, shortness of breath or sore throat. Employers must maintain all information about employee illness as a confidential medical record in compliance with the ADA.

When may an employer take employees’ body temperature during the COVID-19 pandemic?

Generally, measuring an employee’s body temperature is a medical examination. Because the CDC and state/local health authorities have acknowledged community spread of COVID-19 and issued attendant precautions, employers may measure employees’ body temperature. However, employers should be aware that some people with COVID-19 do not have a fever.

May employers require employees to stay home if they have COVID-19 symptoms?

Yes. The CDC states that employees who become ill with symptoms of COVID-19 should leave the workplace. The ADA does not interfere with employers following this advice.

When employees return to work, may an employer require doctors’ notes certifying their fitness for duty?

Yes. These inquiries are permitted under the ADA either because they would not be disability-related or would be justified under the ADA standards for disability-related inquiries. As a practical matter, however, doctors and other health care professionals may be too busy during and immediately after a pandemic outbreak to provide fitness-for-duty documentation. Therefore, new approaches may be necessary. For example, employers could rely on local clinics to provide a form, stamp or e-mail to certify that an individual does not have the pandemic virus.

If an employer is hiring, may it screen applicants for COVID-19 symptoms?

Yes. An employer may screen job applicants for symptoms of COVID-19 after making a conditional job offer, as long as it does so for all entering employees in the same type of job. This ADA rule applies regardless of whether the applicant has a disability.

May an employer take an applicant’s temperature as part of a post-offer, pre-employment medical exam?

Yes. Any medical exams are permitted after an employer has made a conditional offer of employment. However, employers should be aware that some people with COVID-19 do not have a fever.

May an employer delay the start date of an applicant who has COVID-19 or symptoms associated with it?

Yes. According to current CDC guidance, an individual who has COVID-19 or symptoms associated with it should not be in the workplace.

May an employer withdraw a job offer when it needs the applicant to start immediately but the individual has COVID-19 or symptoms of it?

Yes. Based on current CDC guidance, this individual cannot safely enter the workplace. Therefore, the employer may withdraw the job offer.

Families First Coronavirus Response Act

The Families First Coronavirus Response Act was signed into law on March 18, 2020.

In the coming days and weeks, federal regulatory agencies, including the Department of Labor (DOL) and Health and Human Services (HHS), will provide guidance on how to execute or implement the new requirements. In the meantime, employers and advisors must rely on a good faith interpretation of the act’s text.

Note: We are sharing everything we know below and will not be able to answer follow up questions about the act until agency guidance has been released, which will take some time. We will update this page when we have more information, and we encourage you to check here.

Summary

Employees will be eligible for two weeks of sick leave (full pay for self, 2/3 pay for family care) and use of 12 weeks of Family and Medical Leave Act (FMLA) leave (10 days unpaid and then up to 10 weeks at 2/3 pay) for several circumstances related to COVID-19.

Effective Date of Law

- The FMLA and Paid Sick Leave sections discussed below will go into effect on April 2, 2020 and expire December 31, 2020.

- It appears there is no retroactive application.

Key Elements for Employers

- FMLA expansion

- Paid sick leave

- Payroll tax credit

- Group health plan benefit mandate

Emergency FMLA Expansion

- Covered Employers: Employers with fewer than 500 employees are covered.

- Covered Employees: Any employee who has been employed for at least 30 calendar days, though employers can choose to exclude employees who are health care providers or emergency responders.

- Covered Leave Purposes: To care for a child under 18 of an employee if the child’s school or place of care has been closed, or the childcare provider is unavailable, due to a public health emergency, defined as an emergency with respect to the coronavirus declared by a federal, state, or local authority.

- Duration: Up to 12 weeks of job-protected leave.

- Compensation:

- No pay for first 10 days of leave (employee can, but is not required, to use any other leave available to them, including the emergency sick leave discussed below). Employers may not require employees to use paid leave during this period.

- After 10 days, employers must pay two thirds of the employee’s regular rate of pay for the number of hours they would normally be scheduled to work, capped at $200/day and $10,000 total.

- Reinstatement to Position after Leave:

- The same reinstatement provisions apply as apply under the traditional FMLA. However, restoration to position does not apply to employers with fewer than 25 employees if certain conditions are met:

- The job no longer exists because of changes affecting employment caused by an economic downturn or other operating conditions that affect employment caused by a public health emergency, subject to the following conditions:

- The employer makes reasonable efforts to return the employee to an equivalent position, and

- The employer makes efforts to contact a displaced employee if anything comes up within a year of when they would have returned to work.

Note: Employers covered here but not by the rest of the FMLA (i.e. those with fewer than 50 employees) are not subject to civil action by employees (only action by the Secretary of Labor). The act reserves the right for the Secretary to exclude certain care providers and first responders from the list of “eligible employees” and exempt small businesses with fewer than 50 employees if business viability was jeopardized.

Emergency Paid Sick Leave

- Covered Employers: Employers with fewer than 500 employees.

- Covered Employees: All employees (no matter how long they have been employed). Employees who are health care providers or emergency responders may be excluded.

- Covered Leave Purposes:

- When quarantined or isolated subject to federal, state, or local quarantine/isolation order;

- When advised by a health care provider to self-quarantine (due to concerns related to COVID-19);

- When experiencing symptoms of COVID-19 and seeking a medical diagnosis;

- When caring for an individual doing #1 or #2 (2/3 pay);

- When caring for a child whose school or place of care is closed due to COVID-19 (2/3 pay); or

- When the employee is experiencing any other substantially similar condition (2/3 pay).

- Duration of Leave:

- Full time employees are entitled to 80 hours of paid sick leave.

- Part time employees are entitled to sick leave equal to the amount of hours worked on average over a typical two-week period.

- Rate of Pay:

- Sick leave must be paid at the employee’s regular rate of pay for leave used for the employee’s own illness, quarantine, or care.

- Sick leave must be paid at two-thirds of the employee’s regular rate if taken to care for a family member or to care for a child whose school has closed, or if the employee’s childcare provider is unavailable due to the coronavirus.

- Pay is capped at $511/day and $5,110 total for reasons 1, 2, and 3 described above.

- Pay is capped at $200/day and $2,000 total for reasons 4, 5, and 6 described above.

- Interaction with Other Employer-Provided Paid Sick Leave and other Paid Leave:

- This act does not pre-empt existing state and local paid sick leave requirements.

- Employers cannot require employees to use other leave first.

- Sick leave provided for under the act does not carry over from year to year, and the requirements expire December 31, 2020.

- Notice Requirements:

- Employers must post a model notice, which will be provided by the federal government.

Note: The act reserves the right for the Secretary to exclude certain care providers and first responders from the list of “eligible employees” and exempt small businesses with fewer than 50 employees if business viability was jeopardized.

Payroll Tax Credit

- Applies to both the emergency FMLA expansion and the emergency sick leave.

- Dollar for dollar credit for sick leave and paid FMLA wages against the employer portion of Social Security taxes.

- Refund is possible for amounts that exceed what is available as a credit.

- Limits on what can be claimed mirror the caps for what must be paid.

Health Plan Benefit Mandate

- The act requires all insured and self-funded medical plans, including grandfathered plans, to cover diagnostic testing-related services for COVID-19 at 100 percent without any deductibles or co-pays.

- Examples include services provided by doctors, emergency rooms, and urgent care centers leading up to the decision that testing is needed, along with the actual lab-based testing.

- The mandate does not apply to treatment.

Read US H.R. 6201

Carrier Information

The health and well-being of our clients is BBG’s highest priority. In response to the questions and ambiguity around insurance and covered costs, BBG has put together a list of links showing the stance of insurance providers for the testing and treatment of COVID-19.

Medical Carriers

- Aetna

- Anthem

- Blue Cross Blue Shield Association

- CareFirst BlueCross BlueShield

- Cigna

- Florida Blue

- Humana

- Kaiser Permanente

- UnitedHealthcare

Life/Disability Providers

The list has been taken from resources provided by America’s Health Insurance Plans(AHIP) and directly from the carriers’ sites. The information is subject to change based on updated legislation or a change in the carrier’s position.

Resources From Our Carriers

- Aetna – Small Group Options During COVID-19 FAQ

- Anthem – Benefits Coverage During COVID-19 FAQ

- UnitedHealthcare – Fully Insured Plans During COVID-19 FAQ

- UnitedHealthcare – Alternate Funding Plans During COVID-19 FAQ

BBG Response

By now, employers have been inundated with emails about COVID-19. The purpose of this message is not to provide a status on the virus, but assure you that BBG’s operations and the support of your most valued asset, your employees, will be uninterrupted during this time.

As you enact your own internal plan of action, please know that we too have been busy deploying ours, and preparing for remote work. Over the last 18-24 months, BBG has taken the following steps to prepare for this type of business interruption:

- We’ve transitioned from being an exclusively “onsite” workforce, to one which now has nearly 30% in a remote work arrangement, with the remaining support team participating in remote work, as needed.

- We’ve moved our “on premises” email server to one which is cloud-based and can be accessed anywhere.

- All digital files have been moved to a secure cloud server for adequate security, retention and quick access.

- All onsite machines are backed up daily for safe storage.

- Our CMS is 100% web-based and fully secured following all HIPAA protocols.

- All systems have been through rigorous testing in regards to PHI safekeeping practices.

Many of these changes have been instituted over the last several years, while some are also in response to COVID-19. BBG is committed to be part of your success and stability during this time of uncertainty. In addition to applicable information being covered in webinars, BBG will also provide updates via email, newsletter, or social media posts. Please stay connected with us on Facebook and LinkedIn to receive the most up-to-date information.

In the event it is needed, we are also happy to share an abbreviated version of BBG’s internal memo, upon request.